A business proposal (BP) is a written document that is sent to a potential client in order to obtain a specific goal. It is a crucial tool that can help you navigate and manage your business.

The challenge is for you to write a proposal that will keep your prospects hooked!

UNDERSTAND YOUR PURPOSE

It makes perfect sense to begin your journey by identifying and understanding your purpose. Answer this simple question: “What product or service are you selling?

A business proposal is created to earn sales and not just to inform people about what you are offering. Understanding the purpose of your business proposal will help you define the problems it needs to address as well as its solutions that provide value.

CREATE AN OUTLINE

After knowing the direction that you intend to take, it is time to organize your business plan by building an outline. The six fundamental parts of the BP are the executive summary, business overview, offer description, marketing analysis, detailed implementation, and financial projection.

The executive summary is synonymous to the abstract of a research paper. It includes the essential elements of the business plan that your client can easily read in a glimpse. Be sure to include the background of your business, its mission and vision, the market opportunity, its financial requirements, the competitors, and its financial projections.

Business overview gives a background of your business. It includes when and why your business was formed, its mission and vision, its business model, and any existing strategic relationships with other brands or institutions.

As the name suggests, the offer description highlights the nature of the products and services that you are selling. It seeks to describe these in detail by including information such as the manufacturing process and the availability of materials.

Inside the marketing analysis is the layout of your marketing strategy that addresses customer service, sales, public relations, and advertising.

The second to the last section is where the investors focus on – the detailed implementation. This part includes the dates and the deadlines of your business plan.

Lastly, the financial projections specifies the “quantitative interpretation of everything you stated in your organizational and marketing sections”. Include your projected profits and losses in the next three years or so.

DO SOME RESEARCH

Tailor your business proposal to the personality and the “vibe” of your potential client as much as possible. If you prospect’s target market is the youth, highlight the benefits of your products to the hippie millennials. Do further research on the needs and wants of your prospects.

This will ensure that your BP is comprehensive.

WRITE THE CONTENTS

Curtains are all set. It is time to perform! Let your thoughts flow in harmony with the outline you set.

Add additional information such as the people involved in the business, your successful track record, and the evidence of the business’ financial stability. This will strengthen your claims as well as your perceived competence.

EDIT THE PROPOSAL

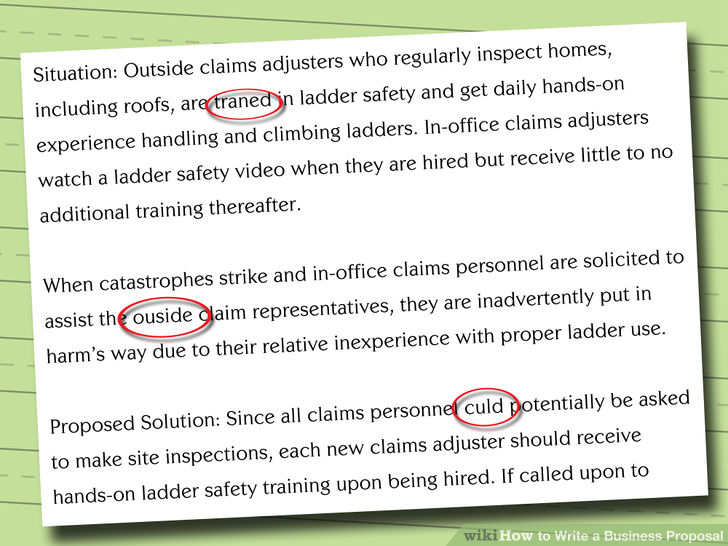

The last step entails that you transform into your own critique. The face value or the appearance is as important as its content. Make sure that there are no grammatical and typographical errors. If you are not good with words, you can always high a professional to do the task.

Remember that the BP must manifest how you and your business can benefit potential clients.

Table 2: Cash rebates applicable on the ANZ Optimum World MasterCard Credit Card

Table 2: Cash rebates applicable on the ANZ Optimum World MasterCard Credit Card

With DBS/POSB banking most of Singapore, the bank sees some 45,000 requests per month for replacement debit or ATM cards, and 7,500 requests per month for replacement internet banking tokens – mostly as a result of misplacement. To use the POSB VTMs, customers will need to have valid ID (such as their identity card or passport) or their ATM card for verification. POSB VTMs will also provide the option of biometric fingervein scanning for verification if required. With POSB VTMs, customers will be able to perform transactions such as:

With DBS/POSB banking most of Singapore, the bank sees some 45,000 requests per month for replacement debit or ATM cards, and 7,500 requests per month for replacement internet banking tokens – mostly as a result of misplacement. To use the POSB VTMs, customers will need to have valid ID (such as their identity card or passport) or their ATM card for verification. POSB VTMs will also provide the option of biometric fingervein scanning for verification if required. With POSB VTMs, customers will be able to perform transactions such as: