Can’t believe we’ve already passed mid-January!

Before CNY arrives, it’s smart to start sending out internship applications before February greets us.

This week we’ve got opportunities in website management, social media management/marketing, and more.

Take a look and apply accordingly.

Good luck 🙂

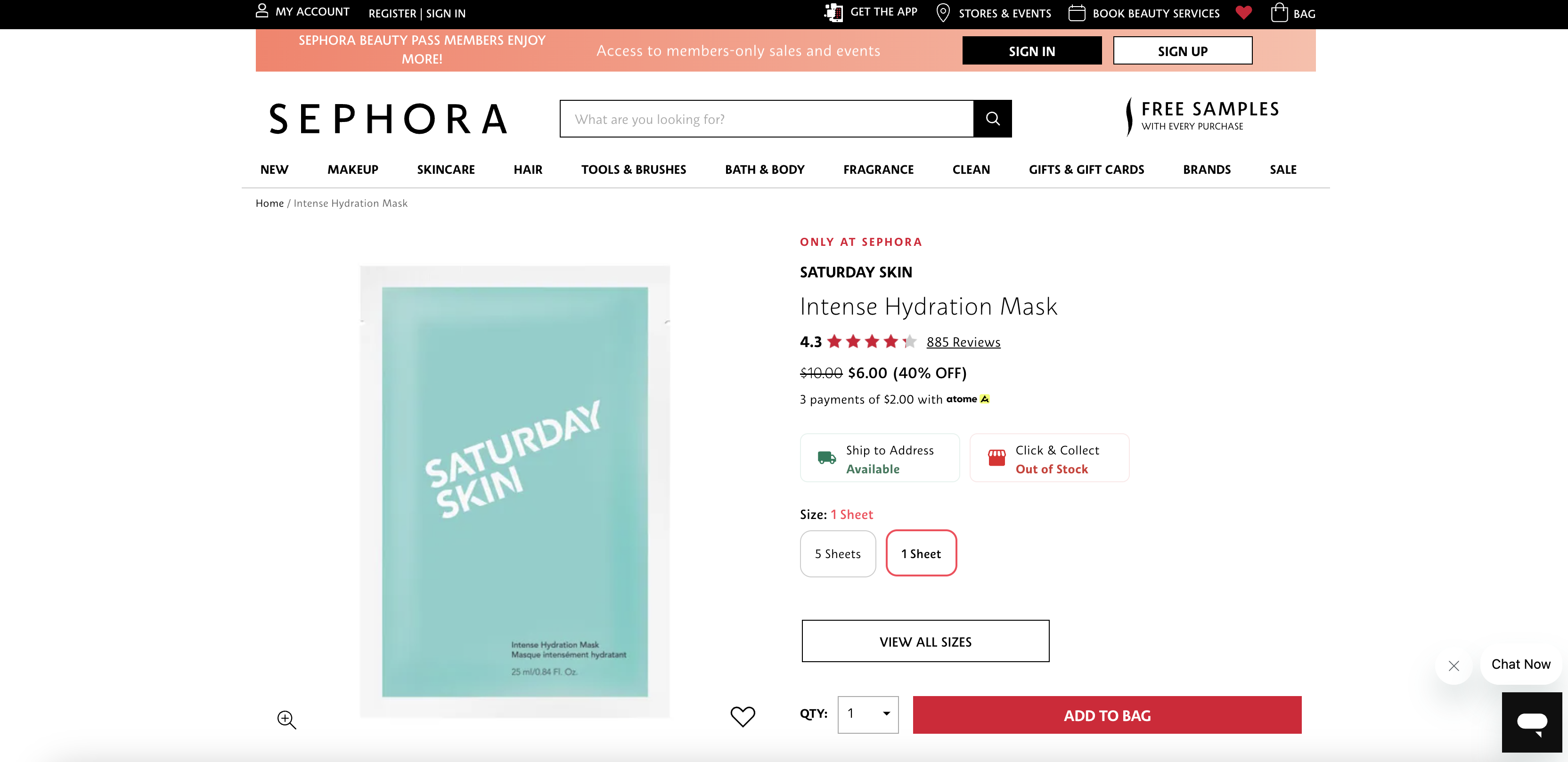

#1: Qurious Media Singapore – Website Intern

View this post on Instagram

Website: qurious-media.com

Allowance / Remuneration: $1,000 – 1,200 monthly

Job Qualifications

- A foundational understanding of or strong interest in web development

- Prior experience in administrative tasks and data entry is preferred

- A proactive learning attitude and a strong work ethic

Key Responsibilities

- Perform data entry and maintain accurate records and databases

- Perform simple web edits to ensure content accuracy and up-to-date information. Candidate must have experience in using WordPress, WIX, and Shopify.

- Ability to perform all aspects of email correspondence, including drafting, sending, responding to messages, and scraping emails.

- Distribute emails and Electronic Direct Mail (EDM) campaigns through the designated platform.

- Complete diverse tasks assigned upon request, which may include one-off assignments such as copywriting and influencer research.

- Adapt to varying tasks per instructions, demonstrating flexibility and resourcefulness in handling different responsibilities.

How to apply?

View the job post here and apply for this position by submitting your resume to [email protected].

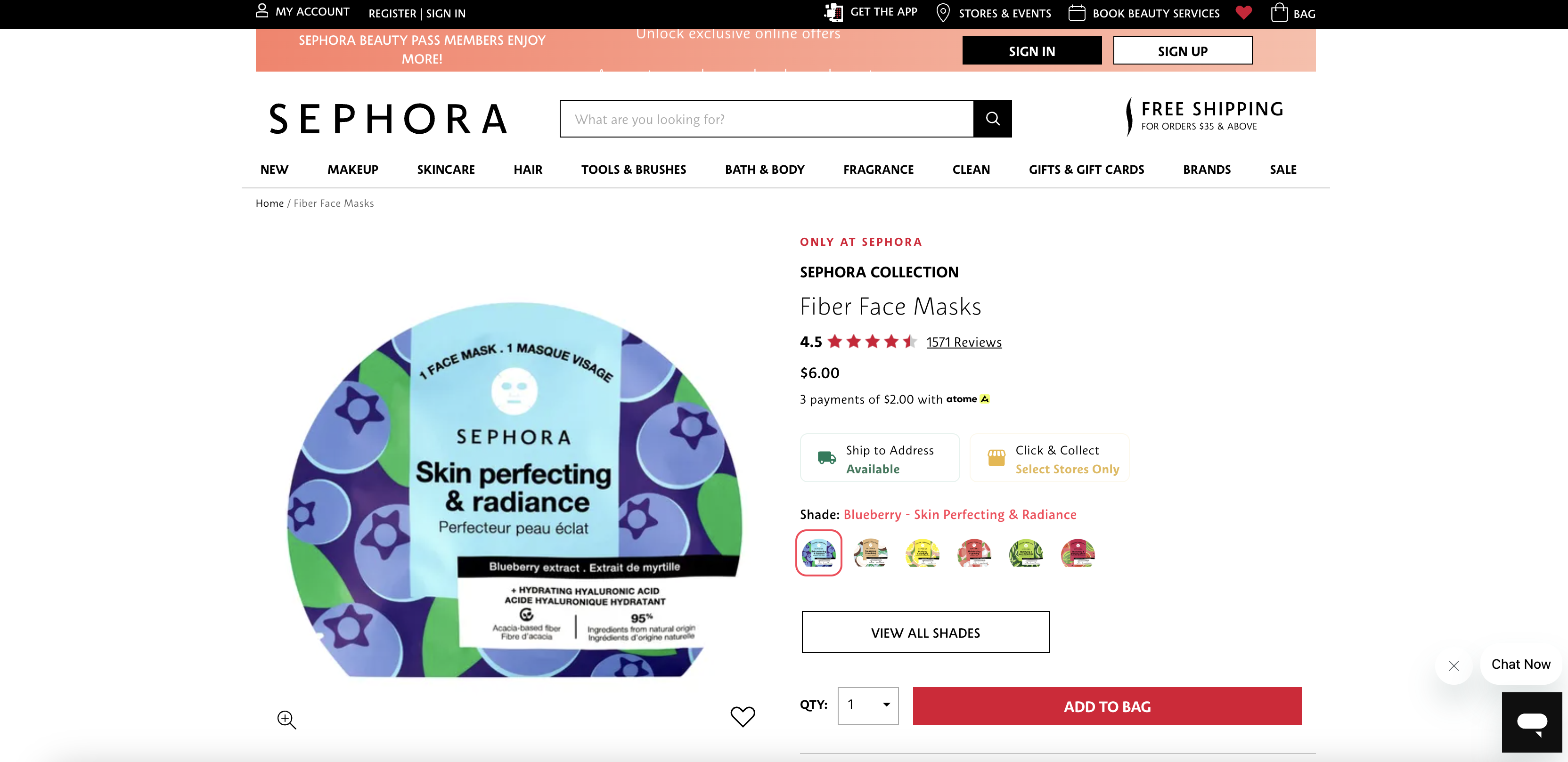

#2: WILDÉBEAUTY.co – Social Media / Marketing Strategist

View this post on Instagram

Website: wildebeauty.co

Allowance / Remuneration: $800 – 1,500 monthly

Job Qualifications

- Outgoing, fun, and confident in front of and behind the camera.

- A creative thinker with a keen eye for aesthetics and storytelling.

- Deeply familiar with TikTok and Instagram trends, and love experimenting with new ideas.

- A natural marketer who understands how to connect with an audience.

- Organized and proactive, with the ability to manage multiple projects at once.

Key Responsibilities

- Manage WildeBeauty’s social media platforms (Instagram, TikTok, etc.).

- Stay on top of social media trends and bring fresh, exciting ideas to the table.

- Create and curate engaging content, including photos, videos, and captions.

- Develop and execute marketing strategies to drive brand awareness and sales.

- Collaborate with the team/influencers, and KOLS to align content with WildeBeauty’s branding and goals.

- Analyze performance metrics and optimize campaigns for better results.

How to apply?

View the job post here and write to Nabilah Khan via this link.

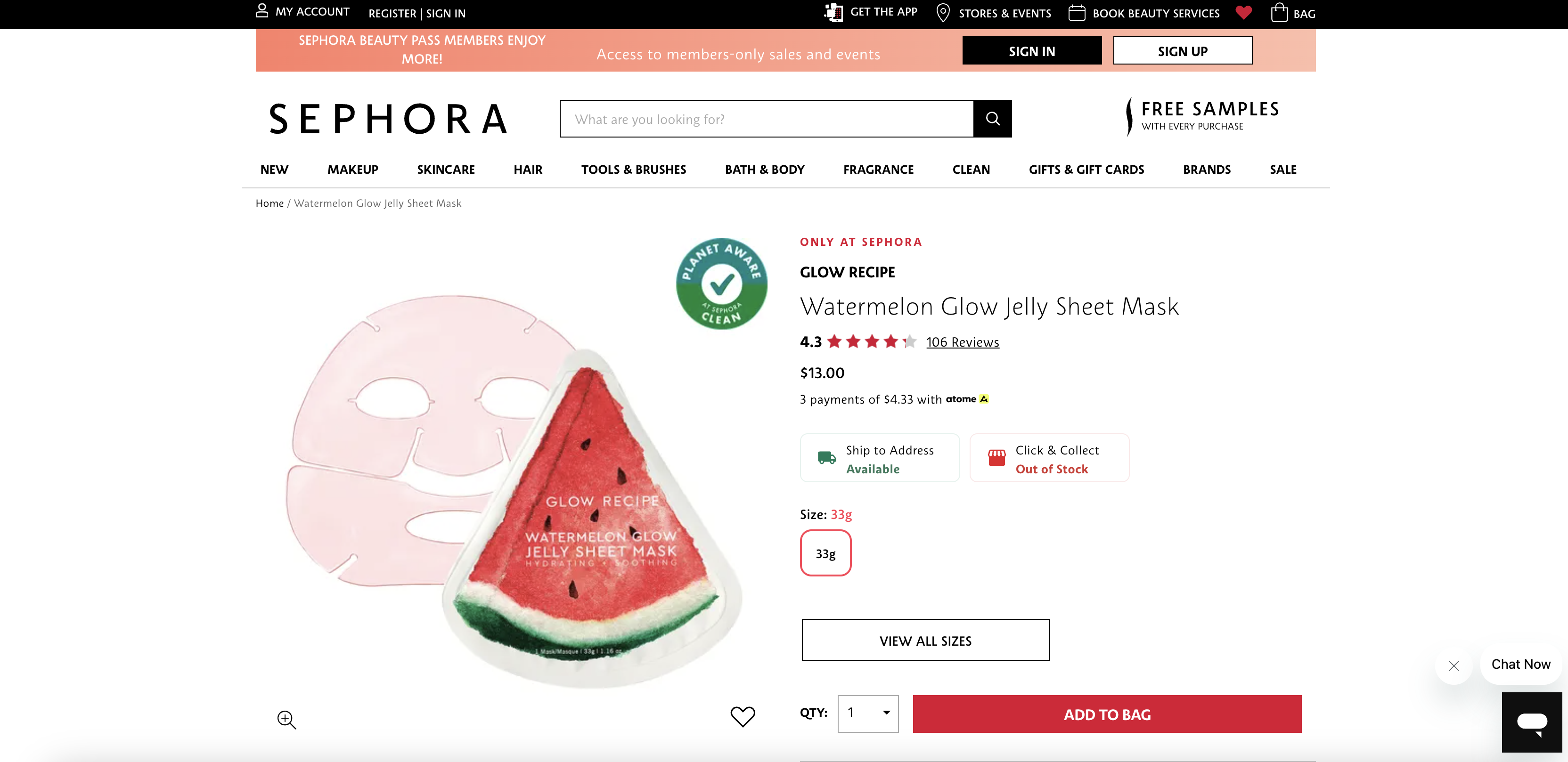

#3: Talk of the Town – Public Relations & Social Media Executive / Intern

Website: talkofthetown.com.sg

Allowance / Remuneration: $800 – 1,200 monthly

Job Qualifications

- Currently pursuing or recently completed a degree in Communications, Public Relations, Journalism, or a related field.

- Excellent written and verbal communication skills.

- Strong organizational and time-management skills.

- Ability to work independently and as part of a team.

- Familiarity with social media platforms (e.g., Instagram, Facebook, TikTok)

- Knowledge of social media analytics and tools is a plus.

- Previous experience in public relations, communications, or social media management is preferred (but not required).

- Passionate about sports (but not required).

Key Responsibilities

- Assist in the development and execution of public relations and social media campaigns and initiatives

- Research media outlets, influencers, and relevant trends in the industry

- Assist with the creation of press releases, media alerts, social media posts, and other communications materials

- Manage social media accounts, including content creation, scheduling, and engagement across various platforms, specifically for Talk of the Town’s channels

- Monitor media coverage and social media performance; report on trends and analytics

- Assist with event planning, coordination, and promotion on social media channels

- Support the team with administrative tasks as needed

- Manage media and social media activities onsite during event week

How to apply?

View the job post here and write to Deborah Rowe via this link.

#4: Parasail – Operation Intern

Website: starboard.ventures

Allowance / Remuneration: $800 – 2,000 monthly

Job Qualifications

- Excellent communication and collaboration skills, with the ability to build and maintain relationships with stakeholders.

- Good sense and acumen to understand business requirements and transform them into product roadmaps and growth plans.

- Good data analytical skills and logical thinking.

- Highly proficient in English.

- Able to start work immediately will be an added advantage.

Key Responsibilities

- Crafting presentations, proposals, and communication materials for internal and external stakeholders.

- Execute product growth strategies based on business needs.

- Facilitate cross-functional communication and coordination to improve product performance.

How to apply?

View the job post here and write to Tin via this link.

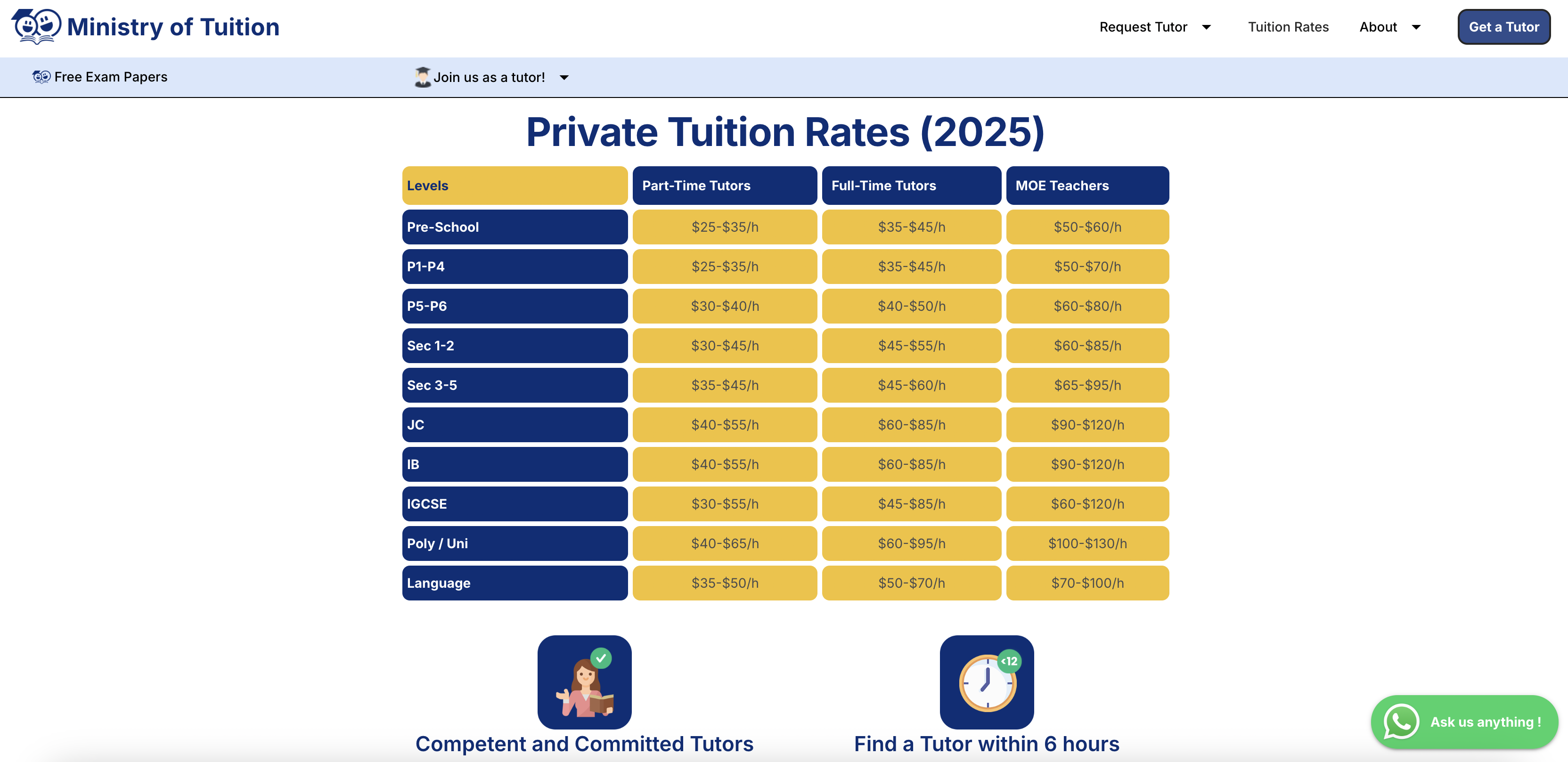

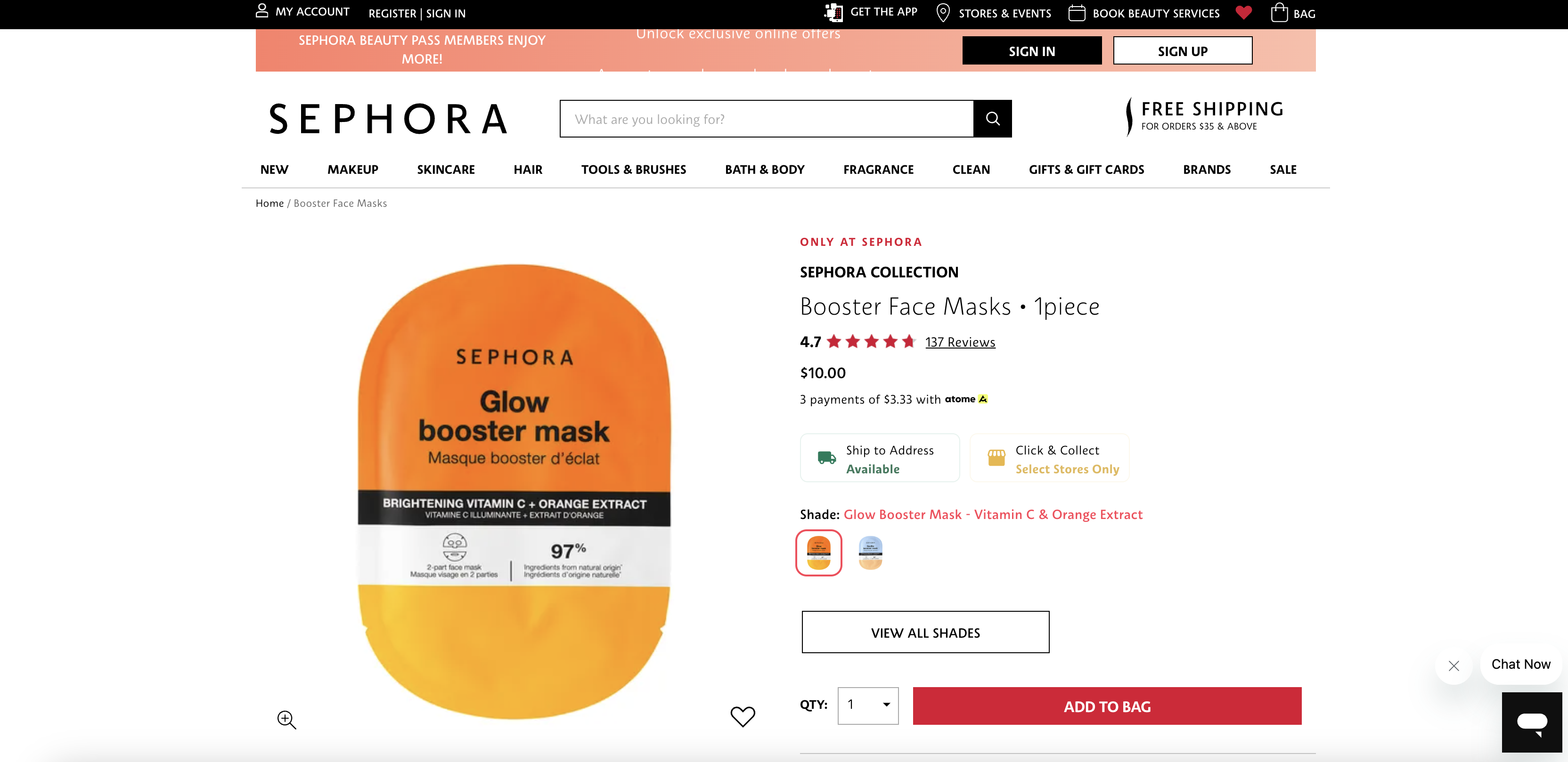

#5: Ministry of Tuition SG – Social Media Content Creator

Website: ministryoftuition.sg

Allowance / Remuneration: $800 – 1,200 (project /contract based)

Job Qualifications

- Creativity and Fun

- Social Media Savvy

- Basic Graphic design skills

- Passion for education

- Strong written and visual communication skills

Key Responsibilities

Content creation:

- Brainstorm as a team to develop creative and funny content (videos and posts) for platforms: Tiktok, Instagram, Facebook, XiaoHongshu, Lemon8

- Plan, script, and film fun and engaging short-form videos (FB Reels and Tiktoks)

- Edit and enhance videos

Planning:

- Schedule monthly content calendar

How to apply?

View the job post here and contact 87853008 if you are interested.

Editor’s note: These positions are selected based on the “remote” tag, but some are hybrid ones and you may need to report physically to the office. For more details, contact the employer directly.