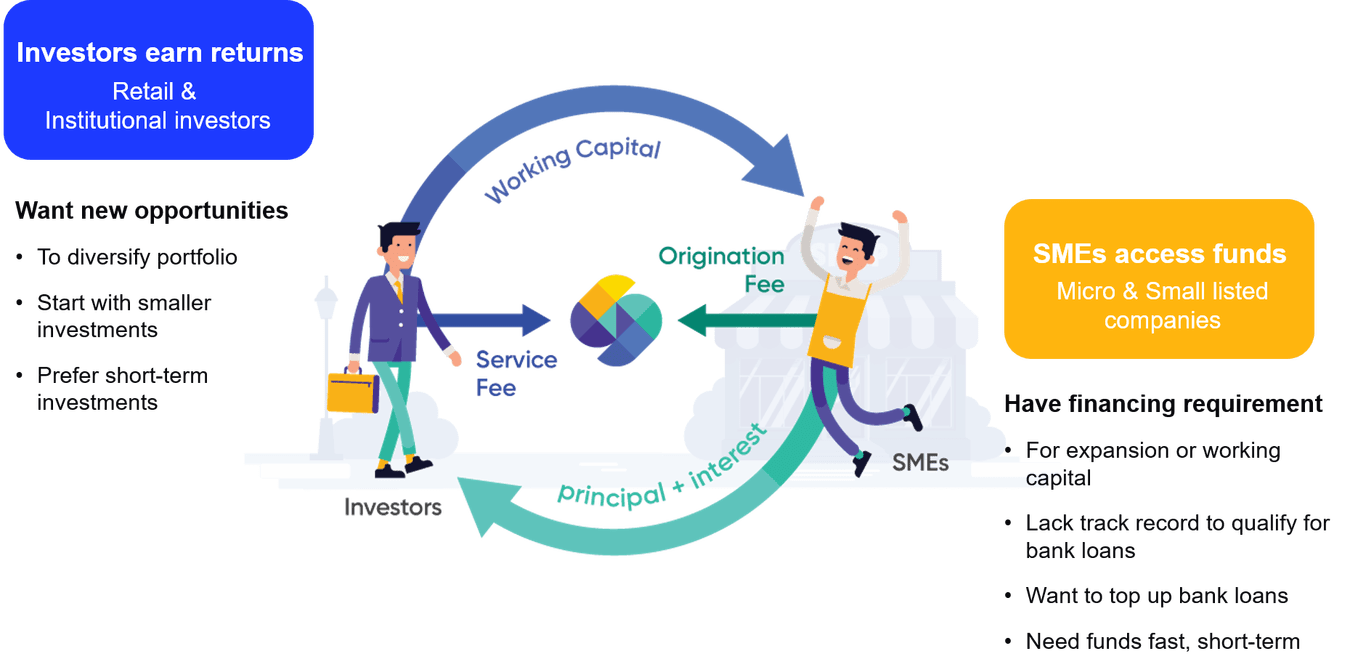

What is P2P investment?

P2P investments or more commonly known as Peer-to-Peer (P2P) lending is a type of debt-based crowdfunding enabled by digital platforms that connect borrowers with investors without going through a traditional financial intermediary such as a bank. This concept will see investors lending to borrowers (i.e. SMEs) via the platform as a form of investment, and the interest earned from it will be their returns. Despite being a relatively new concept in Singapore, it has grown significantly over the years and has shown no signs of slowing down.

How does P2P investment work for investors?

For investors, it is a means for diversification into another asset class. As most P2P investments offer a frequent repayment schedule (monthly or within 90-120 days period), it can be considered a great supplement to more traditional long term asset classes like stocks or bonds. With interest rates on saving accounts heading south, investors can look for alternative ways to earn interest on their cash.

How much can investors earn?

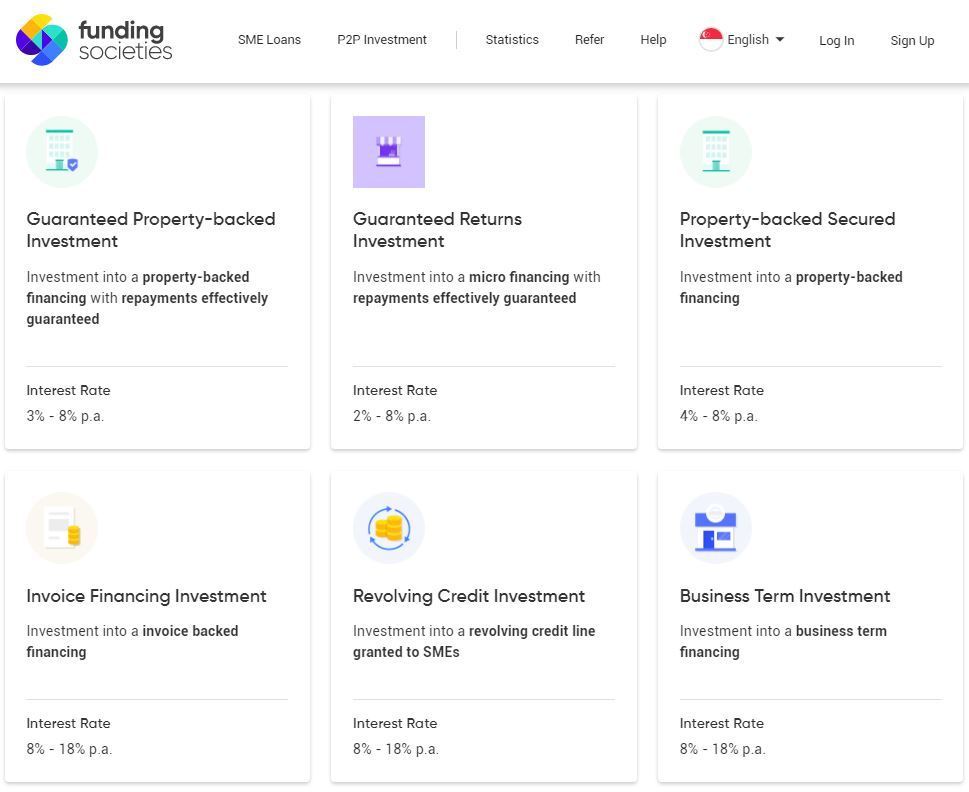

Be it an individual or institutional investor, the reward on their investment will come in the form of the interest payments serviced by the borrower. At Funding Societies, investors can choose to participate across 6 different investment products with interest rates ranging from 3% – 18% per annum.

Risks and returns go hand-in-hand and the difference in interest rates range is tied to the risk associated with the product. For example, a guaranteed returns investment will yield an interest of between 3% – 5% p.a. while an unsecured business term investment can fetch between 8% – 18% p.a..

How much to invest in P2P investment?

There are no hard and fast rules on how much of one’s portfolio should be allocated to any particular investment assets, and this is the same for P2P investing. What is important is that investors should always consider diversifying across many notes and avoid concentration risk to create a healthy well balanced portfolio.

At Funding Societies, investments start from S$20 onwards and most products provide a periodic repayment of principal and interest. Jointly, it is a great recipe for investors to diversify and reinvest their investments.

P2P investment with Funding Societies

Funding Societies is Southeast Asia’s largest P2P lending platform with over S$1.7b in SME financing funded. In Singapore, the platform holds a Capital Markets Services (CMS) Licence and is regulated by the local authorities. Over the years, they have been able to raise several rounds of equity funding led by investors such as Sequoia India, Softbank Ventures Asia and SGInnovate to name a few. A few things to note when investing with Funding Societies:

- Interest returns are exempted from tax: For interests earned in year 2020 onwards

- Low barrier to entry: Investments start from $20 per note

- Short tenor: Investment tenors ranges from 1 to 12 months

- Returns on Investment: Interest rates usually range between 3% to 5% per annum for a Guaranteed Investment product, 6% to 8% per annum for a Property-backed investment and 8% to 18% per annum for Invoice financing and unsecured business term investments

- Default Rate: The Singapore platform default rate is 1.89%

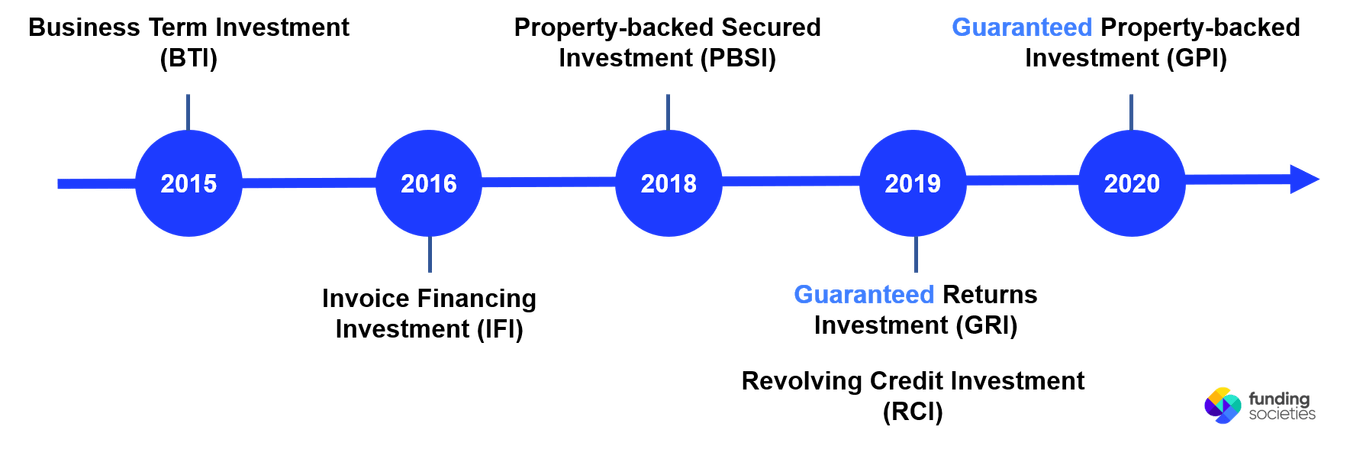

P2P investment products

As the investor base grew overtime, they needed to continuously innovate new products to meet the needs of a wider range of investor profiles. Having launched the first product back in 2015, Funding Societies has now grown to offer 6 different investment products with varying levels of risk-return profiles.

TL;DR: P2P Investment Products Overview

1. Property-backed Secured Investment

The Property-backed Secured Investment (PBSI) is a rather unique collateral-backed investment product launched to provide investors with an additional security in the form of a local Singapore property to back the investment. The property is pledged by the SME undertaking the financing.

Funding Societies holds first charge on the property on behalf of investors and it can be auctioned off to recover funds should the SME defaults.

To alleviate concerns on property value fluctuations, the percentage of financing amount varies as per the property types (residential/commercial/industrial) and in most cases is only up to 70% of the property value. The forced value of the property is also considered while arriving at the financing quantum. By doing so, Funding Societies maintains a buffer for fluctuation in property prices as well as for distress sale situations. The interest rate for this investment product is typically between 4% – 8% per annum.

2. Guaranteed Property-backed Investment

Launched in July 2020, Guaranteed Property-backed Investment (GPI) is an investment into a Property-backed Secured Investment with an additional effective guarantee of repayments to investors. Likewise to Property-backed Secured Investment, Funding Societies has the right to liquidate the property to recover the funds should the SME fail to fulfil their obligations.

Falling under the Guaranteed line of products means that both the principal & interest repayments are effectively guaranteed to the investor regardless of the SME’s status. The interest rate for this investment product is typically between 3% – 8% per annum.

3. Guaranteed Returns Investment

Guaranteed Returns Investment (GRI) is another investment product under the Guaranteed line of products. This product was first launched in August 2019 as a means to offer more investment opportunities to investors.

GRI is an investment into a micro financing with repayments effectively guaranteed. Similar to GPI, investors are effectively guaranteed to receive both the principal & interest repayments when they participate in this investment product. The interest rate for this investment product is typically between 3% – 5% per annum.

Please invest with the knowledge that while returns are effectively guaranteed by FS Capital Pte. Ltd., there may be a chance where we might not be able to fulfil the obligations under this arrangement. To mitigate this risk, a cash reserve buffer to allow for repayments to be made on time is maintained.

4. Invoice Financing Investment

The Invoice Financing Investment (IFI) product allows investors to invest into an invoice backed financing offered to SMEs. SMEs take this financing by pledging against the receivables of an invoice. By doing so, it helps to bridge the cash flow gap between actual sales and receipt of payments.

Due to the nature of the financing, investors in this product usually enjoy a relatively short tenor of 30 – 120 days. The short tenor enables investors to receive and reinvest their money relatively quickly. The interest rate for this investment product is typically between 8% – 18% per annum.

5. Revolving Credit Investment

If you own a credit card, you will probably be aware of how revolving credit or more commonly known as a line of credit works. Based on one’s credit standing, they will be issued a credit limit to draw down from over time. Likewise in the case of Revolving Credit Investment (RCI), it is an investment into a revolving credit line granted to SMEs. The SME can repay anytime within the approved tenor and draw down again so long as the amount outstanding is within the limit.

As an investor, you can participate in a single or multiple drawdowns, each with a tenor typically between 1 to 12 months with a chance of early partial or full repayments. The interest rate for this investment product is typically between 8% – 18% per annum.

6. Business Term Investment

Business Term Investment (BTI) was the first product offered alongside the launch of the Funding Societies platform back in 2015. It is an unsecured financing undertaken by SMEs as a means for working capital, expansion or bridging needs. The interest rate for this investment product is typically between 8% – 18% per annum.

Be it a way to diversify your investment portfolio or to beat the falling savings account interest rates, investors can consider to embark on their P2P investment journey with a platform like Funding Societies. If you have done your own due diligence and decided to invest with Funding Societies, they currently have a promotion for new investors. Sign up with promo code MDXMAS20 and make a total investment of S$200 by 31st Jan 2021 to get a S$20 cashback.

Terms and Conditions apply

Investors must sign up with the aforementioned promo code and make a total investment of at least S$200 by 31st Jan 2021 to be eligible for the $20 cashback. Cashback will be credited into the eligible investors’ accounts by the end of February 2021. Funding Societies’ investor T&Cs apply.

Funding Societies is the largest SME digital financing platform in Southeast Asia. It is licensed in Singapore, Indonesia and Malaysia, and backed by Sequoia India, Softbank Ventures Asia Corp and SGInnovate amongst many others. It provides business financing to small and medium-sized enterprises (SMEs), which is crowdfunded by individual and institutional investors. Investors can invest from as low as S$20 with a tenor of no more than 12 months. Depending on the investment product, interest rates can range between 2% to 18% per annum.