Ready to go beyond the basic “konnichiwa” and gain mastery of the Japanese language?

Allow us to help.

In this article, you will find a list of top-rated Japanese language schools in Singapore to help you achieve fluency and confidence in speaking Japanese.

Let’s roll!

Tomo Japanese Language School

Website: tomo-japanese.com

Google Rating: 5 (560+ reviews)

Address: 190 Clemenceau Ave, #03 #02, Singapore 239924

Forget textbook drudgery because, at Tomo Japanese Language School, fluency means fun first.

Their teaching method weaves together speaking, reading, writing, and listening to “train” you into an all-rounded Japanese speaker.

But it doesn’t stop at language.

Beyond the classroom, you will be exposed to the REAL culture of Japan, no tourist cliches there.

These practical lessons equip you with the real-world skills to thrive in Japanese business and society, whether you dream of working in Tokyo or simply want to connect with locals at a deeper level.

Tuition fees are priced at $450 for a 10-lesson term.

Tsubasa Language Services

Website: learnjapanese.sg

Google Rating: 5 (30+ reviews)

Address: 808 French Rd, Singapore 200808

Tsubasa Language Services isn’t your run-of-the-mill language school.

It features passionate local instructors, armed with rigorous teacher training, and can guide you on a journey through language, cuisine, travel, values, and more.

Starting from just $260 for an 8-class beginner package, Tsubasa makes Japanese fluency accessible easily.

What began as one man’s dream has blossomed into a well-sought-after destination for those seeking a better understanding of the Land of the Rising Sun.

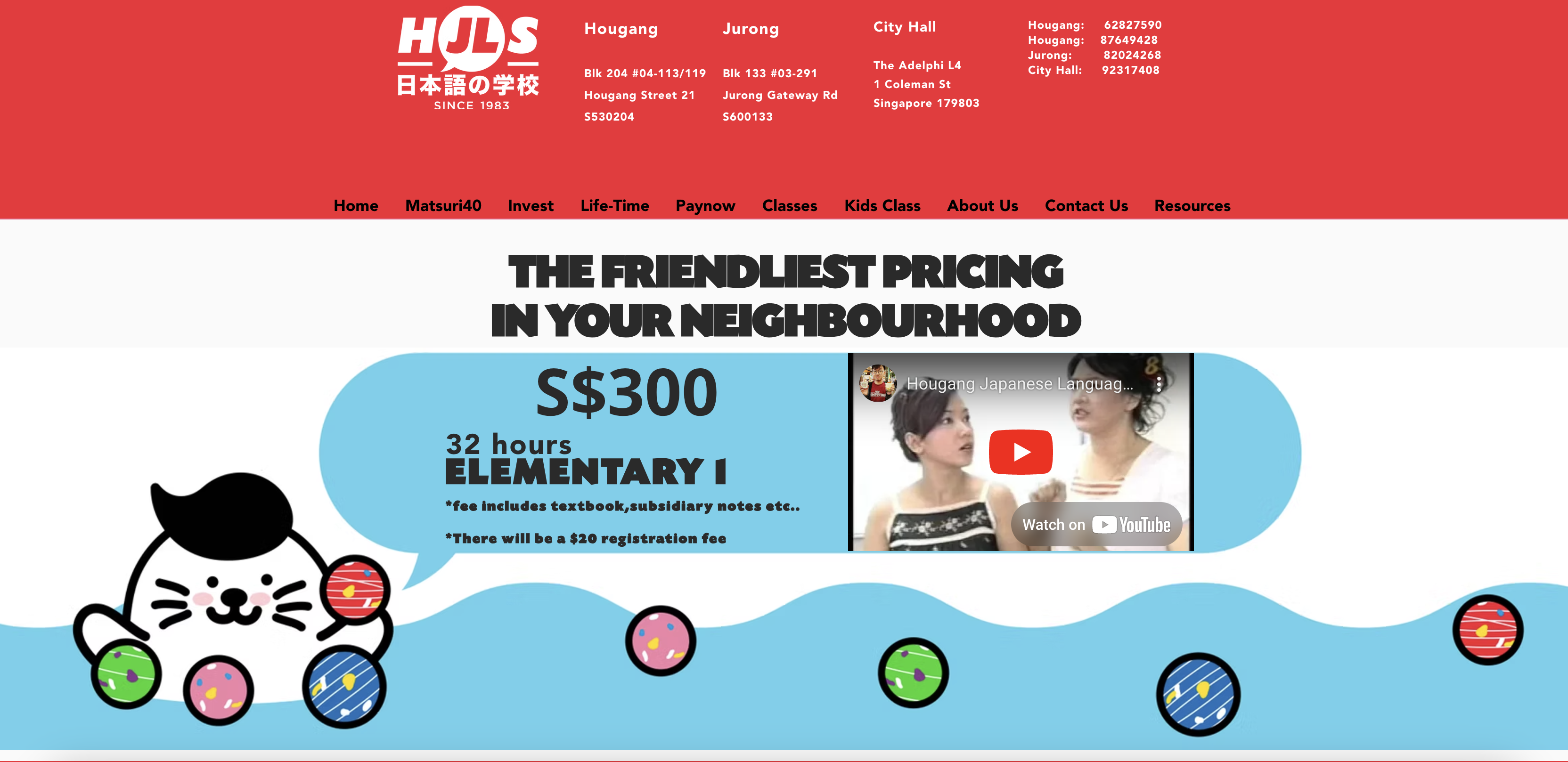

Hougang Japanese Language School

Website: hougangjapanese.com

Google Rating: 5 (20+ reviews)

Address: 134 Jurong Gateway Rd, #02 303A, Singapore 600134

Founded in 1983 by Mr. Kenji Kitahara, a master of both Japanese linguistics and Chinese Mandarin, this school has spent over 40 years nurturing Singapore’s curiosity about Japan.

Now helmed by his son Yutaro, the family’s devotion to Japanese education remains unbroken.

Their beginner’s Elementary I course starts at just $300 for 32 hours of learning.

Or go all-in with the exclusive “lifetime student” membership, allowing unlimited learning for one affordable fee (from $1000).

Taiyo Japanese Language School

Website: taiyo.edu.sg

Google Rating: 5 (10+ reviews)

Address: 20 Kramat Lane United House #05-05, Singapore 228773

Last but not least, you will want to cast aside visions of dusty Japanese textbooks and droning grammar lectures.

At Taiyo Japanese Language School, their approach makes learning the language as engaging as it is effective.

From day one, you will be taught practical, everyday conversation phrases so those follow-ups after “konnichiwas” roll off your tongue with confidence.

They will cover grammar to build your fluency, but rules take a back seat to real-world speaking.

After just one week, you could find yourself throwing out Japanese with your boss or clients over lunch.

The path to Japanese mastery is paved here not with tedious drills but with a curriculum focused on lively dialog and role-playing.