When first learning how to budget, it can get overwhelming very quickly. How can you divide your income into all of these little categories? What if you don’t have enough money to spread across the budget? How many categories should you have on average?

If you’re a new budgeter with questions like those, then you’ve come to the right place. We have five budgeting tips for beginners that are sure to help you out.

First, Research

Before you begin, do some researching about finances. Learn what other people do to manage their budgets and finances. Learn from their mistakes and make a note of their pointers. Remember, though, that not every tip or method you come across will work for you. However, that doesn’t mean you can’t try them.

Determine Your Average Income

You need to have an income to divide for your budget. The best way to come up with this number is to look at what your household income was for the past few months. If you have a salary that doesn’t change, then your average income will be fairly straightforward.

If your income varies from month to month, add up the previous several months and divide it by however many months you’re going with. It’s best to err on the side of caution and go with a lower number, than work a budget with an unrealistic income.

Decide the Focus of Your Budget

Your budget needs a focus. The focus you decide on is what you’ll put more money towards. If you need to pay off debt, then you’ll make adjustments to your spending so that you can allocate more money to your debt. It could be a vacation budget to take your family on that trip you’ve been waiting for.

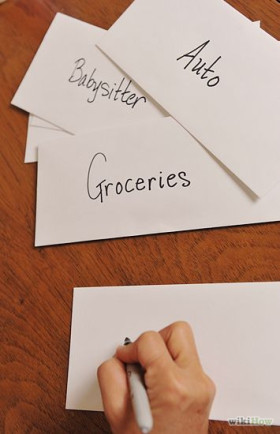

Write Out Your Top and Fixed Expenses

Your first expenses to look at should be the ones that you have to pay no matter what. These will include items like your rent or mortgage, loan payments, and vehicle insurance. Ideally, these should be the ones that remain constant month after month.

Next, write out your significant expenses that vary each month. With these expenses, they would be categories like groceries, medical expenses, and utility bills. It’s not that these expenses are less important than the first ones listed. Instead, they are the ones that may change in price depending on the month.

The money left over is what you have to work with for your various expenses that aren’t a high priority (eating out, entertainment, morning coffee runs), or into a savings or investment account.

Have an Emergency Fund Category

Did you know that not many Americans have an emergency fund, or would they be able to handle an unexpected expense thrown their way? An emergency fund should be something that you put money aside in every month that is there to pay for the unexpected.

The more you have in your emergency fund, the less you’ll need to rely on outside help from friends, family, or even personal loans from companies like Credit Ninja. Although they are helpful in those situations, using your own money is a good feeling to have.

Don’t let budgeting intimidate you. Once you get the hang of it after a few months, you’ll soon realize how beneficial they are. You’ll have months in which you’ll blow the budget, and that’s okay. Work at staying on track the following month.