Crowdfunding is a relatively new concept that has rapidly gained popularity in Singapore. It is a means by which a large number of people can finance a business via a platform.

There are four distinct types of crowdfunding, each of which caters to different requirements:

1. Donation Crowdfunding – Here, people give money for a project that may be a charity event or even a business idea without expecting any return. The amount paid can be considered as a contribution for a project in which the donor strongly believes.

2. Reward Crowdfunding – This form of crowdfunding is similar to donating crowdfunding in the respect that the individuals who extend finance do so as they want to help the venture or product that is being promoted. But in reward crowdfunding the person who makes a donation gets some form of non-monetary benefit or reward.

3. Debt Crowdfunding – This is a commercial transaction where multiple lenders loan money to a borrower, usually a small corporate or business. The lenders receive interest directly from the company that has taken a loan.

4. Equity Crowdfunding – Investors buy equity or ownership in a company in the expectation that they will receive dividends and capital appreciation.

Debt crowdfunding, the focus of this write-up, allows investors to use technology and the internet to lend money to small and medium-sized Singapore companies. If investors take the correct approach, they can make a reasonable return that is much better than what is offered by banks, while ensuring the safety of their principal.

Conversely, investors who do not take basic precautions may find themselves chasing high returns and putting their capital at risk.

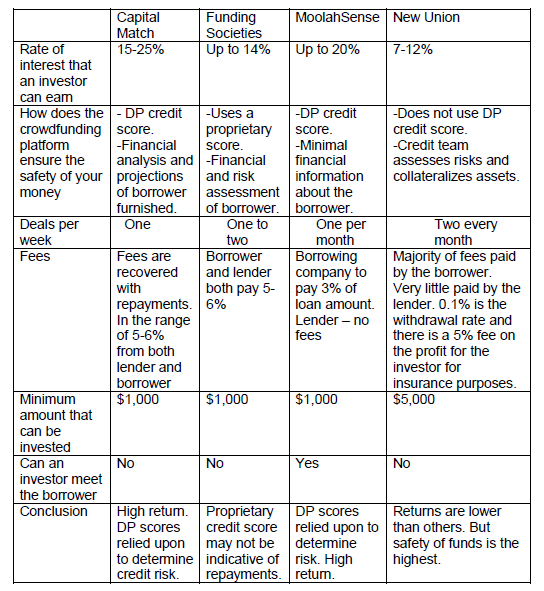

There are four debt crowdfunding platforms in Singapore. Investors should analyze how they operate before they decide which one is the most appropriate for them:

Most of the borrowing companies have a DP score of between 5 and 8. A score that is at the lower end or higher end of this spectrum does not indicate much because a borrower may still default. Theoretically, a lower DP score would reduce the chance of a default but not eliminate it. An investor should not base his decision to lend money on this factor.

Currently, that New Union offers the lowest rate of interest for investors at 7 to 12%.

But it has done the most businesses among all the crowdfunding platforms in Singapore – well over $20 million till date (for loans done within Singapore)

As an investor, my personal take is that the reason for this seeming anomaly is that it offers the safest avenues for investors’ money. Personally, I’m more into preserving my capital while making a reasonable return on it.

New Union also has their own credit risk team who assesses the risk profile of the borrower. If the team determines that the creditworthiness of the borrower can be enhanced by taking collateral, it ensures that this is done. In fact, based on what I noticed, the New Union debt crowdfunding platform does most of it deals with either collateral or invoices to back the transaction.

Debt crowdfunding can be a good addition to a person’s portfolio as it gives higher returns while providing a reasonable assurance about the security of the principal. Investors who explore this option will see that the existing debt crowdfunding platforms in Singapore vary quite widely in their approach.

While a majority of them promises high returns they do not generate much confidence when it comes to the safety of capital. An investor who is using a debt crowdfunding platform for the first time would be well advised to do a thorough due diligence of not only the borrowing company but of the platform well.

* This publication is for general circulation only. It does not form part of any offer or recommendation, or have any regard to the investment objectives, financial situation or needs of any specific person. Before committing to an investment, please seek advice from a financial or other professional adviser regarding the suitability of the product for you and read the relevant product offer documents, including the risk disclosures from the respective institutions. If you do not wish to seek financial advice, please consider carefully whether the product is suitable for you.