Lower your tax bill by maximising the tax reliefs available to you, and pick up some tax filing tips for a smooth tax season.

Tax season 2019 has begun, and like most Singaporeans, you may once again be required to file your taxes this year. From filing your taxes to utilising the tax reliefs at hand, here’s a quick way to a breezy tax season.

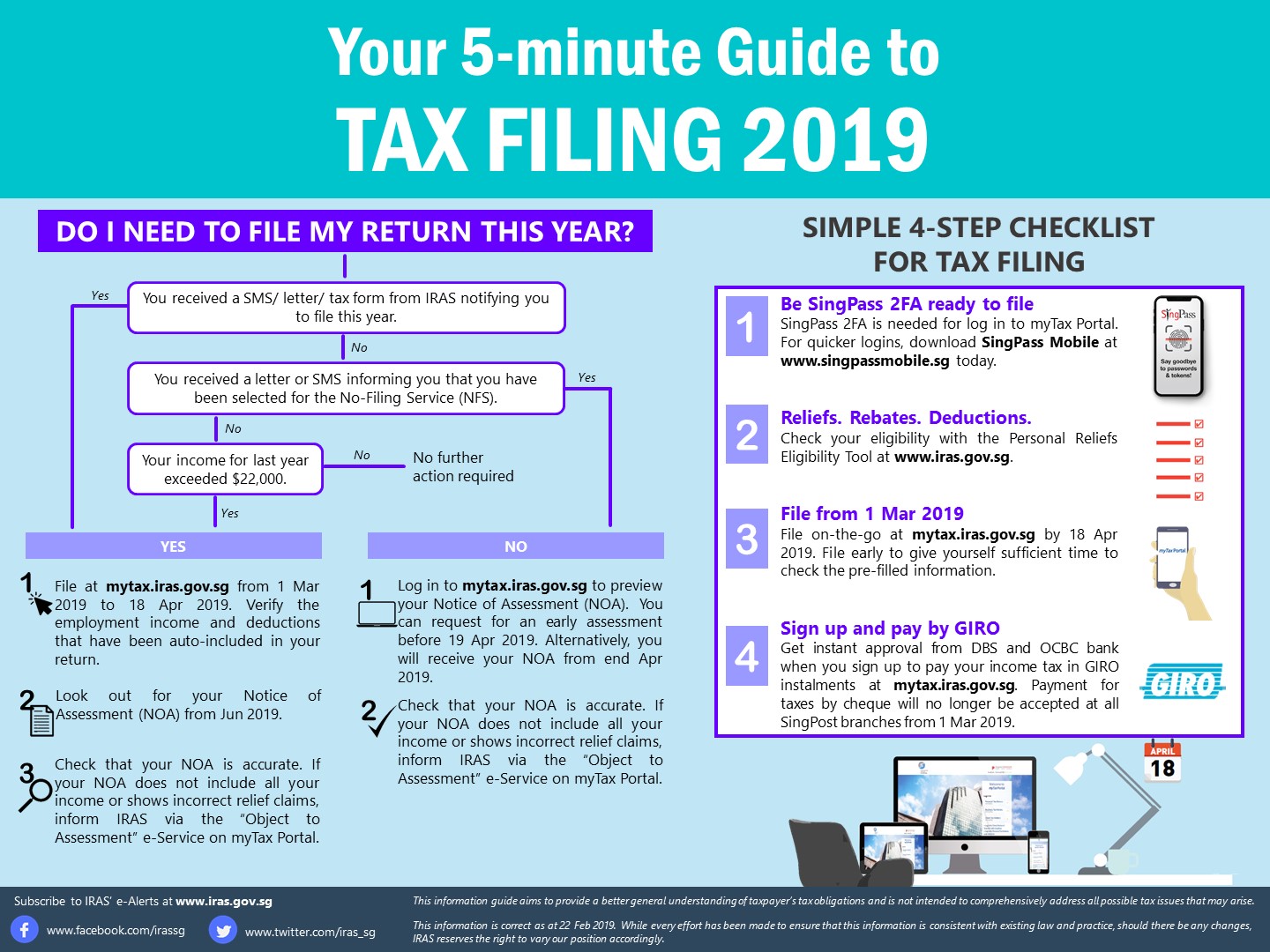

5 minutes: Find out if you are required to file your taxes this year

To file your taxes or preview your Notice of Assessment, log in to https://mytax.iras.gov.sg using your SingPass.

10 minutes: Edit your tax return and claim the tax reliefs available to you

Your income information may have already been pre-filled in your tax return if your employer is under the Auto-Inclusion Scheme. This means that your employer submits your income information to IRAS on behalf of you. However, if you received additional income in 2018 or spot an error in your tax return, hit ’Yes, I need to edit my Tax Form’ to ensure that these are reflected in your return.

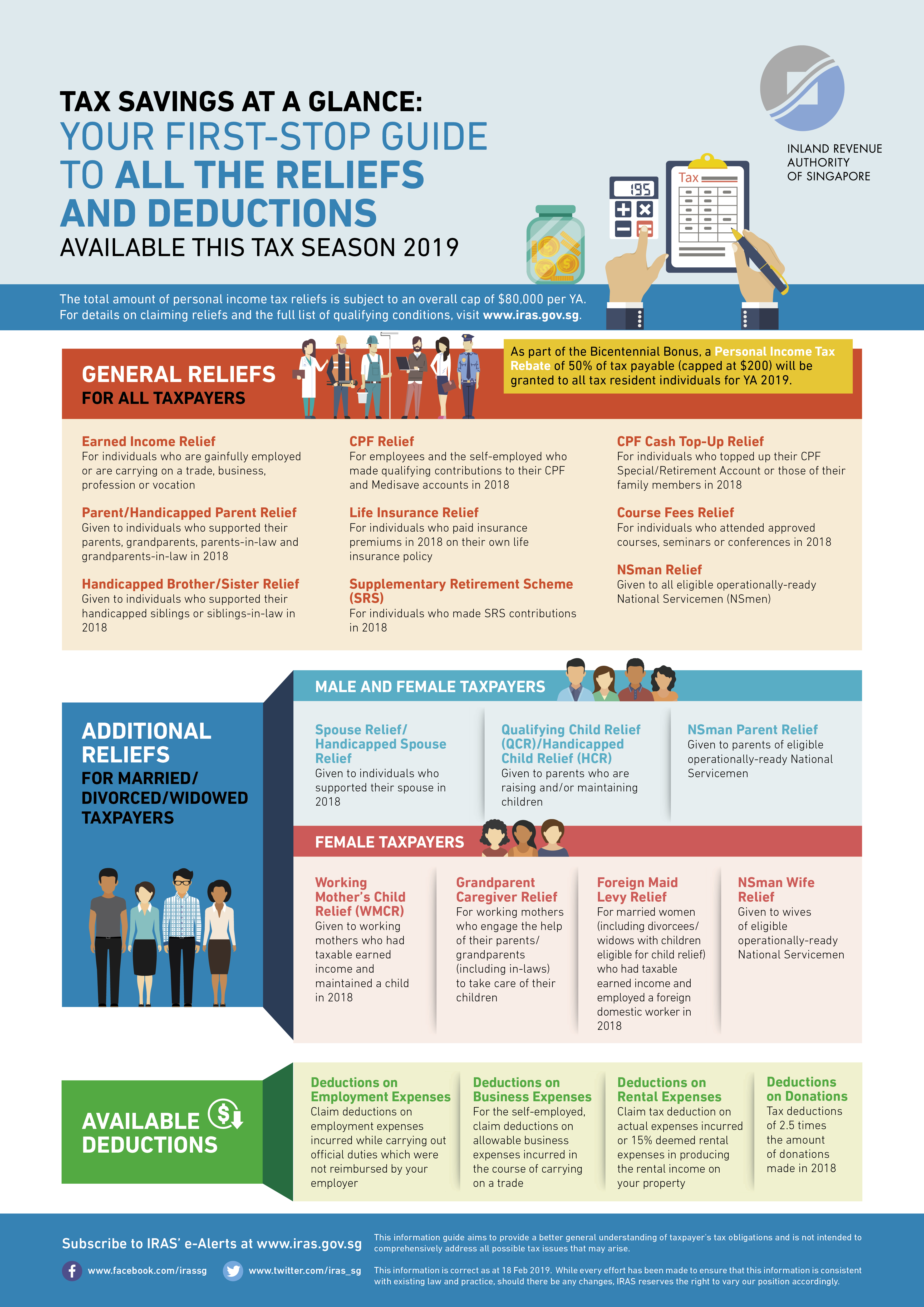

Tax reliefs and deductions are targeted at certain groups of people to encourage social and economic objectives, such as filial piety and the advancement of skills. If you are eligible for any of the tax reliefs below, be sure to make your claims for them in your tax return for a lower tax bill!

Find out more about the tax reliefs – the qualifying conditions and claim amounts – at https://www.iras.gov.sg/irashome/TaxSeason2019/

And you’re done for the year!

When you’re ready, hit Submit before logging out. An acknowledgment message will be displayed upon successful submission of your tax return. Your tax bill will be sent to you between end Apr and Sep 2019. In the meantime, sign up for GIRO if you have yet to for a hassle-free tax payment experience.

Remember, file your taxes at myTax Portal by 18 Apr 2019 to avoid the last-minute rush and late filing penalties.